Ever feel like you’re cutting it a little tight before you get your next paycheck? Do you have a credit card you want to pay off before it reports to the credit bureau, but you don’t get paid until after the statement cuts?

If you like millions of Americans, you might live paycheck-to-paycheck and sometimes have a tougher time making ends meet when an unexpected expense arises. It is through times like these that you need an answer to help get you to the next paycheck, but payday loans should always be set aside as a last resort.

This is where ActiveHours comes in!

ActiveHours is an app built on a simple principle: helping you get the money you need without charging you an arm and a leg.

The app is available for both iPhone and Android devices, and securely connects to your online bank account login and verifies your direct deposit. They may ask you to provide copies of your past pay stubs to verify this information, but once your account is fully verified, it’s smooth sailing from there!

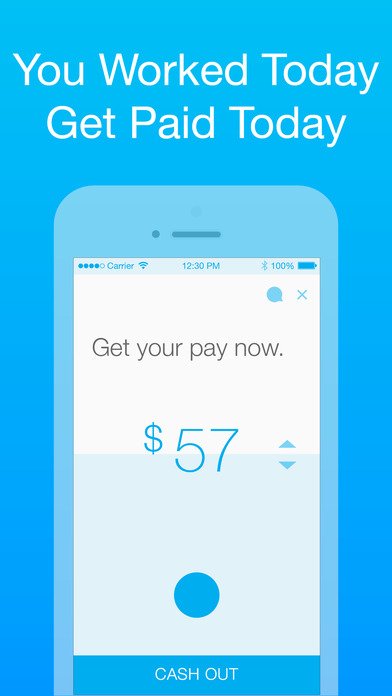

Using your phone’s location, the app tracks how much time you’ve been at work and makes those hours available to you within 24 hours – meaning you can get paid almost immediately after leaving the office!

You might be thinking: “This all sounds great…but how much does it cost me?”

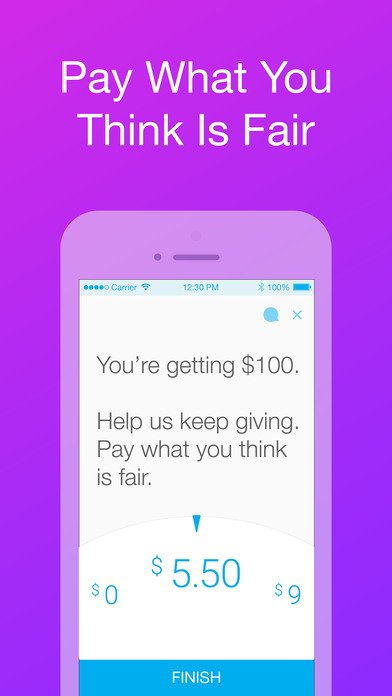

Well, the truth is – you don’t have to pay anything if you don’t want to!

Yes, you read that right! ActiveHours doesn’t charge interest or fees for their service. Instead, they allow customers the option to give the company a tip, saying “pay what you think is fair”. The tip can range anywhere from $0 – $10, so you don’t have to pay anything if you don’t want to!

The service is built to protect both consumers and the company by using a series of levels in pay disbursement called “Maxes”. Users will have both a “Daily Max” and a “Pay Period Max” which are the limits on how much you can borrow per day and per pay period.

All users have a $100 Daily Max to prevent them getting ahead of themselves too quickly, and each user’s Pay Period Max varies depending on a mixture of criteria: money management, use of the app, keeping bank information current, and the number of employees at your company that use the app.

The most you can borrow in one pay period is $500 and the total amount borrowed is withdrawn in full (plus any tip) on your following payday.

In addition to providing a unique approach to payday lending and eliminating the massive amounts paid in interest and fees by consumers each year, ActiveHours is also introducing groundbreaking new features that dramatically improve the payday-borrower experience!

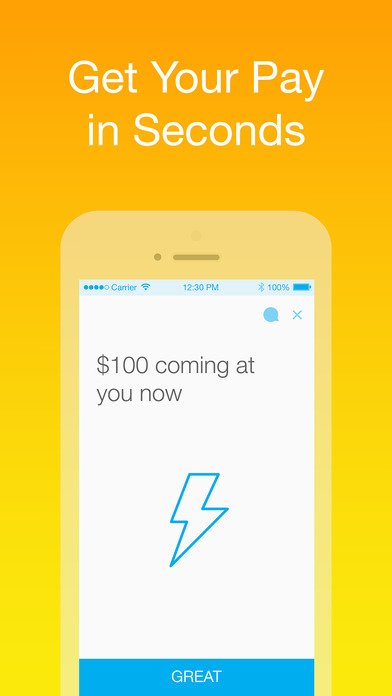

Lightning Speed is a feature most often seen in person-to-person payment apps like Square’s “Cash” app, and allows folks to receive a deposit instantly on their debit card instead of waiting for an incoming transfer to post to their account!

A large number of major banks are supported and the service is free for ActiveHours users! It only takes a few seconds (sometimes minutes) for the deposit to hit your account once you request the cash within the app.

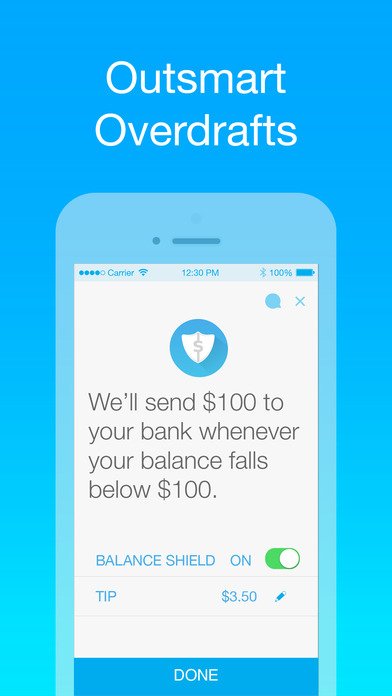

Balance Shield helps protect users by providing an intuitive form of overdraft protection. Once you turn on the feature, if your bank account balance falls below $100, the app will automatically send $100 to your account in order to protect you from getting hit with an overdraft fee.

The Balance Shield feature will only work if you haven’t hit your Daily Max or Pay Period Max and allows you to establish a pre-set tip for the service.

Overall, we think this service and app are an amazing way to revolutionize the predatory lending that many have fallen victim to while also helping users save money by preventing overdrafts!

Everyone should have a budget and work diligently to avoid needing to borrow money at all, but sometimes life events happen and you need a helping hand. ActiveHours is here to help!

Download the app at the links below and if you enjoyed this article, please share it with your friends!

Recent Comments