Known among financial bloggers as the easiest way to get approved for a credit card without a hard pull, this trick is also an excellent tool for those with bad credit or on a rebuild path. Even if you’ve recently filed bankruptcy, this trick is going to be your best friend!

The “Shopping Cart Trick” or SCT is a common promotion/sales tactic used by various retailers to get more people signed up for a credit account with them. Basically, they do a soft pull on your credit report and see if you meet their minimum criteria, if you do, they automatically offer you a credit account without you needing to apply!

Here’s a simple example of how it works:

- Customer adds items to cart.

- Customer proceeds to checkout stage.

- Customer enters billing/shipping information.

- Store/Bank uses billing information to perform a soft credit check.

- Store/Bank offers credit account before customer completes purchase.

The SCT only works with select retailers / card issuers and is almost exclusively used by Comenity Capital Bank who is the bank that supports a very large number of store credit cards.

People who have been approved through the Shopping Cart Trick are from all different kinds of credit – even really bad credit! We have seen people with charge-offs, multiple missed payments, judgements, and much more qualify for credit cards through the SCT!

The Shopping Cart Trick – Step By Step

- You MUST be opted in for promotional offers.

If you haven’t manually requested to be opted out, you are already opted in. It’s recommended that you opt-in to the promotions anyway, because you never know when you’ll get an awesome offer in the mail! (You can change your status for promotions at any time by visiting this site.) - Disable Pop-Up Blocker & Clear Browsing History

The easiest way to do this is using Google Chrome. Go to settings and type “pop up” in the top-right search bar. This will bring you to the content settings where you can disable pop up blockers. Next, you’ll want to open a private browsing or “incognito” window before continuing onto Step 3. - Visit Retailer Website & Register For Rewards Program

Pick one of the retailers from the list below and visit their site from your private browsing window. Make sure you register for their rewards program using the information listed on your credit report. (If you do not know which address is listed on your report, it’s a good idea to sign up for Credit Karma and verify before proceeding.)Note: Sometimes not logging into your rewards account and checking out as a guest will give you the pop up. Personally, I experienced this with Express. For some reason it wouldn’t give me the pop up, but when I tried it a few weeks later as a guest, it appeared.

- Add Items To Cart & Head To Checkout

Pick a few items out that you may/may not want (you don’t actually have to buy them to get the card). There are mixed reports of adding more items to the cart and getting higher limits, but these rumors are not backed by hard data.Most consumers say that they’ve gotten the Pre-Approved pop up after adding $50-$200 in the cart. Credit limits handed out with these cards are normally less than $500 but will grow as you use them. - Enter Billing & Shipping Information

IMPORTANT: Make sure the information you enter here matches exactly to what is displayed on your credit report!For example, if your credit report lists your address as 1234 Arlington St Apt 42, and you type it as 1234 Arlington Street Apartment 42, you likely will NOT get the pop up because the system can’t match the information to your credit profile.Type at a leisurely pace as you fill out the fields and do not use an autofill / auto-populate feature to put the information in.

- Accept The Offer

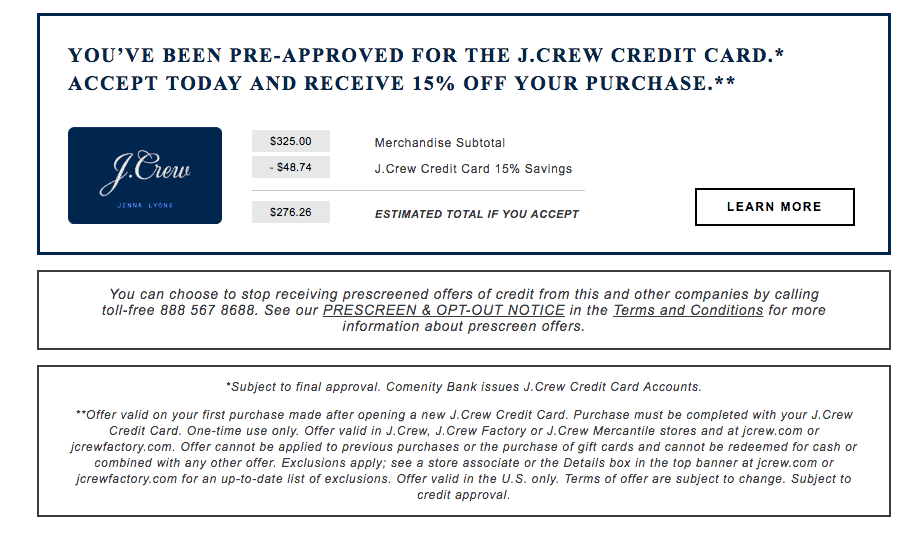

Once you reach the page to input payment information, you should get the pop up if the system has prequalified you – it may take a few seconds for the pop up to appear so let the page finish loading completely before taking any action.For example, the J. Crew pop up may look like this:

When you see the offer pop up and proceed to the acceptance page, make sure you check to see if they are requesting your full SSN or just the last four digits. Commonly, card issues will only require the last four if they are doing a soft-pull, and if you are being asked for your full SSN, this is a red flag that they may perform a hard credit check.Once you’ve accepted the offer, your card will be ordered and they will likely ask you to add your new credit account as your default payment method – we recommend doing this in case you want to order something before your new card arrives.

After accepting the offer, you can feel free to either continue with your purchase or abandon your cart completely. Neither will have an effect on you receiving the card. (Personally, I have never purchased anything immediately after accepting the offer because I prefer to shop in-store.)

If for some reason you did not get the pop up, go back through the steps and make sure you follow them exactly.

They do not offer the cards to everyone, and even someone with a perfect score may not get the pop up on the first time for a number of reasons, such as:

- The bank may not have updated their pre-qualification system before you do the trick.

- You may have entered information that doesn’t match your credit profile.

- You may not qualify for that particular store’s card, or your credit report shows items that disqualify you.

- The total of items in your basket is too high for the credit limit they would initially offer you.

- The store does not participate in the SCT pre-qualification program any longer.

If you do not get a card you want, come back in about 21 days and try again. Usually that is enough time for all systems to update and pull new pre-qualification lists.

Below is a list of known stores where folks have gotten a pre-approval pop up and received a card. Please note: this list is not all-inclusive and some people may not be able to get every card.

- Ann Taylor

- Brylane Home

- Buckle

- Boscov’s

- Coldwater Creek

- Express

- Gamestop

- HSN (You will need to go to the very last stage of checkout and likely enter your own payment information.)

- J.Crew

- Jessica London

- JJill

- King Size Direct

- Loft

- New York & Company

- One Stop Plus

- Overstock (It will ask for your full SSN no matter if doing a hard or soft pull. Caution is advised after getting mixed reports of both.)

- Romans

- Sportsman Guide

- Venus

- Victoria Secrets (Card can be used at both Bath & Body Works and White Barn)

- Wayfair

- Williams-Sonoma

- Woman Within

It has been said that Victoria’s Secret, J.Crew, and Overstock are the stores most people have found success with, but results may vary and not all people will be approved for these offers.

If you’ve had a successful experience or an issue with them, please post in the comments below and we will update this post as new information becomes available!

Just went through these steps on the Wayfair site and was pre-approved for $1000 CL prior to checkout.

I have a very low score of 582. I am rebuilding credit. I was so shocked when Victoria secret approved me for $250.00 with the shopping cart trick. I was all excited and tryed pretty much all on the list for two weeks and nothing…no other pop ups or offers then finally I tryed William Sonoma just now and boom $250.00 I also tryed a credit one card and so far says I’m approved. So excited to rebuild credit.

@martha you should try for capital one platinum. They are easy to get with rebuilding credit. Not the rest but platinum offers this for people. I was apprives with less credit than you have now.