Think you weren’t allowed to join Navy Federal because you don’t have a family member in the military? Think again.

For many people, getting into an exclusive credit union like Navy Federal Credit Union (NFCU) or USAA is the stuff of dreams. And for even others, they would have been eligible but a family member didn’t join when they could have, so their shot went out the window too.

In this post, we are covering the hidden way non-government civilians are allowed to join NFCU, and the things you should be careful when doing this.

Note: this process is one of NFCU’s allowed methods of joining their credit union, but it’s just rarely talked about as they are marketing their services / products specifically to military members and their family.

There is nothing illegal or immoral about this process and it is 100% approved by NFCU. There are, however, several important points you need to pay attention to so they don’t reject your application, but we will get to those later.

*Whatever you do, do not submit an online application for membership. You will get rejected.*

Step 1. – Join The Navy League of the United States

Founded in 1902, the Navy League is a non-profit organization dedicated to supporting America’s sea services (Navy, Marine Corps, Coast Guard, etc.) and are known as the trusted civilian partners of the sea services’ mission, personnel, and families.

It’s a wonderful organization to join even if you do not wish to join NFCU. Many members who join solely with the goal of obtaining NFCU membership continue their enrollment in the Navy League for many years.

You will need to join the Navy League under the San Diego chapter. This is an important detail you cannot miss. If you do not join under the San Diego chapter, you will not be eligible for NFCU membership.

The most common plan is the $25 E-Membership and can be found here.

Within a couple days, you’ll receive a welcome email from the Navy League. Once you’ve gotten that you can proceed to Step 2. You must have a copy of the email in order to be eligible for membership with NFCU.

Step 2. – Print the NFCU Membership Application

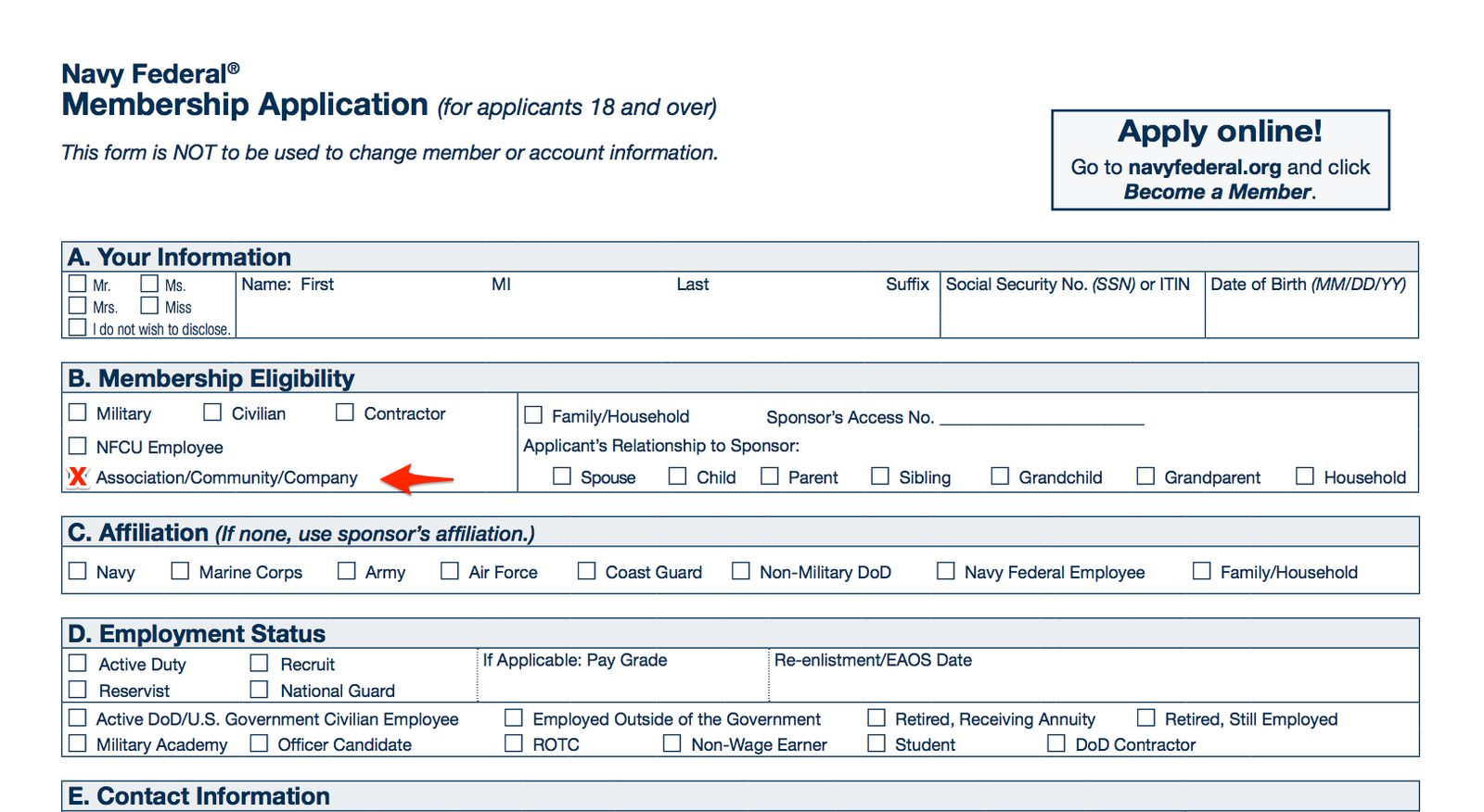

Download the PDF of the official membership application from NFCU’s website and fill it out by hand.

It is incredibly important to fill out the application completely and with accurate information. There have been many instances in which members have had their accounts frozen or terminated because of issues with the information they list on their application.

Make sure you select “Association / Community / Company” under the eligibility section – unless you qualify as a member in another way.

Step 3. – Submit Your Application (In person or via fax)

When you have the copies of required documentation that the application asks for (usually ID, utility bill, SSN card) head into your local branch and submit it with a new account specialist.

Alternately, since NFCU is open to all U.S. residents, you may not live near a branch. If this is the case, you must submit it via fax or by mailing it in (not recommended).

Do not submit your application online, over the phone, or through any other method than the ones described here in this post. Your account will be frozen and/or terminated if you apply that way.

Once you have completed all of the steps above, NFCU will run a credit check and pull a report from EWS to make sure you meet basic criteria. They will also require that you sign an additional document agreeing to account terms. Watch for a separate piece of mail that they will send you if you applied via fax.

After passing the required checks, you should be a new NFCU member with great benefits! Look for the welcome packet in the mail (or email) and get ready for a wonderful relationship with one of the best financial institutions out there!

Hello there. I do not believe that NFCU is still allowing people to become members through joining the Navy League. Has anyone tried this method recently? Such as this Spring past or this present Summer? Just wondering. I’m thinking of submitting an application for membership.

Thank you.

This method Was cancelled in May 12, 2017.