The biggest factor in being financially healthy is knowing where your FICO Score stands – and now you can get that information for free!

You may be thinking “I already get my credit score for free with Credit Karma” however the scores they provide aren’t used by 90% of lenders and financial institutions.

Credit Karma and other similar services provide free scores that are created using a different way to “score” your report. Some of these are called VantageScore, TransRisk Score, or FAKO Score.

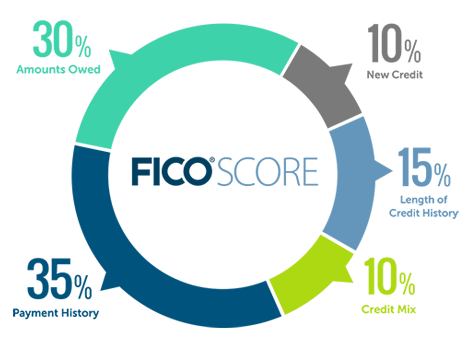

A FICO Score is the official score issued by Fair Issac & Co. and is based on the most widely-used scoring method, called FICO8. Here is how the FICO8 model weighs each item on your credit report and builds a score.

Credit: myfico.com

The other types of scoring methods count these factors for different percentages which is why they will often give you a different score than what FICO displays.

Getting Your FICO Score For Free

Most places you look for credit report monitoring will offer you the chance to purchase your FICO Score, but with a new program called FICO Open Access, companies are opening the door and providing FICO Scores to their customers for free!

The trick to getting your score 3x per month is to use the programs/companies listed below and sign up at different times of the month so that you are able to see your score multiple times monthly!

For example, if you have a credit card that gives you a free FICO Score with your statement and your statement cuts on the 15th, you should sign up for Discover Scorecard on the 5th of the month, and then sign up for an account with FreeCreditScore.com on the 27th so that you can monitor it all month long!

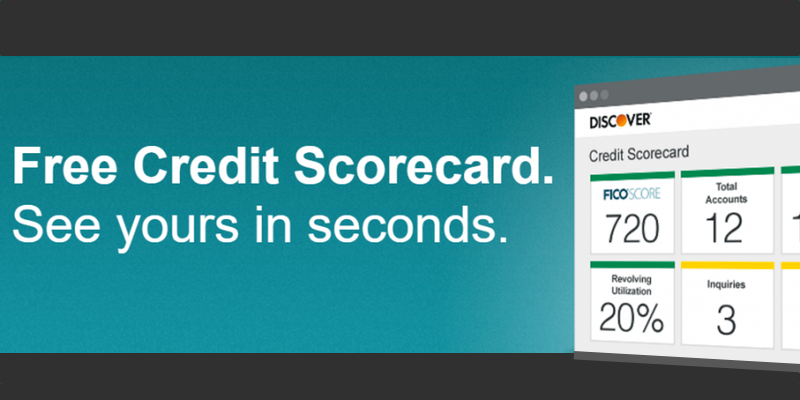

#1. Discover Scorecard

One of the most consumer-friendly lenders, Discover was one of the first companies to begin offering free FICO Scores to their customers with their monthly statements, and now – you don’t even have to be a customer to get your free FICO Score!

Discover is offering a free FICO 8 score to everyone at their Credit Scorecard website. The scorecard updates once a month, and allows you to see several factors that have contributed to your score. Discover also promises that they will not sell your information to 3rd Parties, but it is assumed they will likely target potential customers with pre-approval offers using the information.

Note: Checking your own credit score/report will not harm your score.

#2. FreeCreditScore.com

A part of Experian, FreeCreditScore.com is now completely free and open to everyone! They give you access to your full Experian report and score.

Your Experian report will be updated each time you login (according to their FAQ) and your FICO Score will be updated every 30 days.

#3. Bank Account or Credit Card

Many credit card issuers and even some banks offer a free FICO Score with your monthly statement or available for online banking. See the list below to see if your bank participates!

(Note: not all accounts / credit cards from each issuer are eligible for a free FICO Score)

Credit Cards:

American Express

Bank of America

Barclaycard

Chase

Discover

First National Bank of Omaha

Huntington Bank

PenFed

Merrick Bank

Partners 1st FCU

Walmart (Both Discover & Store Card)

Wells Fargo

Bank Accounts:

Digital Credit Union

Partners 1st FCU

PenFed

Save & Invest.org

Unitus Credit Union

As always, your experience may vary with the products/institutions listed. Please contact the companies for details and availability.

Recent Comments