If you’ve ever felt it was hard to follow a budget or you just couldn’t get a handle on your spending – this bank account could be your saving grace.

With one of the most intuitive, clean-cut, and (no pun intended) simple banking apps and user interfaces that I’ve ever experienced, Simple Bank really puts their customers first.

The whole concept behind Simple’s magical software and mobile app is their approach that merges banking and budgeting together – something that should’ve happened a long time ago!

When I first heard of Simple, I was skeptical. My spending was out of control, and I kept forgetting which bills I needed to pay and every time I looked at my “Available Balance” I believed I had more money than I did – this was because I couldn’t separate it mentally.

After using Simple for a year, I was able to get completely out of debt (minus student loan), actually save money for certain things, and organize my finances so that I can live by a budget. I’m no longer panicking because I realize that my car insurance bill (the one I forgot I had to pay) hadn’t been drawn from my account.

Truly, this account has helped me stop living paycheck-to-paycheck on recent grad’s income and allowed me to enjoy life because I’m no longer confused by my finances. I know exactly how much I have, and exactly how much I am able to spend.

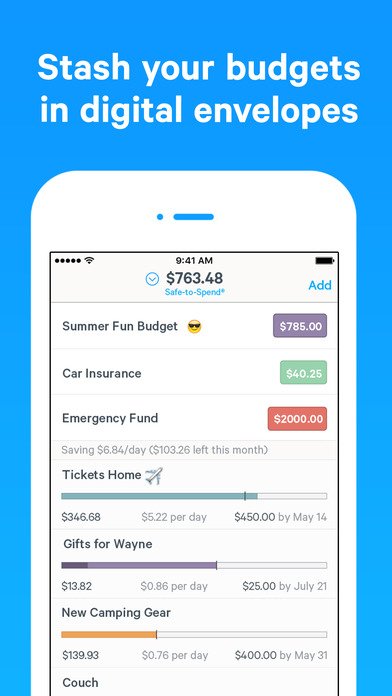

If you’ve ever heard of ‘Envelope Budgeting’, this approach will be very familiar to you.

Basically, Simple lets you stash money into separate compartments or “goals” so that you can see the money you have left over after your bills are paid. These goals can be for a bill, savings, transfer, or any other reason.

When you place money in a goal, say for your car insurance, that amount is deducted from your “Safe-to-Spend” amount. Once your car insurance gets charged to your Simple account, you can open the transaction and tell the app to pull the funds from your car insurance goal.

With this system of digital budgeting within a banking app, you can clearly see the money you need to keep for upcoming bills and your discretionary income is spelled out as your “Safe-to-Spend”.

As you can see from the image above, Simple allows for you to save in two different ways.

1. Stash money in a goal for a specific bill. (Ex: Summer Fun, Car Insurance, Emergency Fund)

2. You can save over time by having the app automatically move money into a goal. The app will ask “How Much?” and “By When?” and then calculate how much to move each day. (Ex: Tickets Home, Gifts for Wayne, New Camping Gear)

Once you’ve gotten all your bills separated into different “goals” the next part is easy!

Each time your paycheck hits your Simple account, sit down with the app (or on your computer) and put the money for bills into your goals. After you’ve filled all the goals you need to for that paycheck, you can see exactly how much money you have left over! This will be what shows in your “Safe-to-Spend”.

You can even take this approach a step further and create goals for coffee, gas, shopping, etc. This way, you are setting limits on how much you spend for certain types of purchases. Then, when you hit up Starbucks, open the Simple app and have the transaction pull from your “coffee” goal.

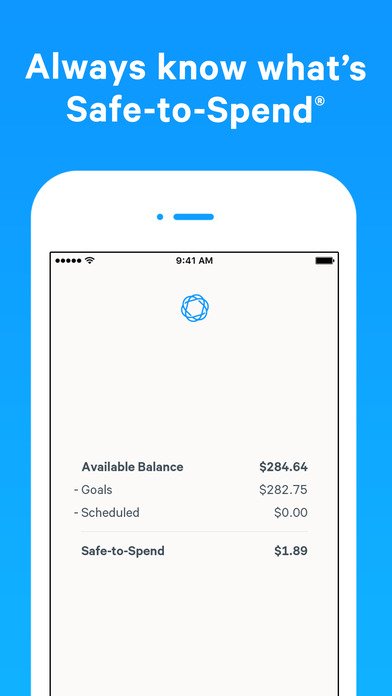

As you see above, Simple displays your balance in a different way than you’re used to, but it’s very smart.

As any bank would, Simple shows you exactly how much money you have in your account by displaying your Available Balance. This is a total accounting of what money you have, both “Safe-to-Spend” and “goals” plus any scheduled transfers.

They then break it down by showing you the total amount you have placed in all your goals, what you have scheduled as transfers or payments, and finally, what is left over from that as your “Safe-to-Spend”.

Note: The goals will not prevent you from overspending your “Safe-to-Spend” and are more of a refreshing visual and mental way for you to look at your finances. It’s your job not to overspend. Simple, as any bank would, will let you spend the entirety of your Available Balance.

The awesome part is if you do happen to overspend, the next time you get a deposit, the app will automatically replace that money within the goals it was taken from.

Beyond the fantastic budgeting features, Simple offers a lot of other free features to their customers on top of providing a free checking account.

ACH Transfers – All outgoing transfers to external bank accounts a completed in 1 business day. (Internal pull requests may take 3-5)

Photo Check Deposit – Simple offers free photo check deposit to its customers that takes 1-2 business days to clear, but could take longer depending on several factors.

Digital Checkbook – You can mail a check to anyone using this handy feature. No more writing checks! Checks take several business days (Note: You cannot use traditional checks with Simple account/routing numbers. They do not offer/support them.)

Bill Pay – Simple offers bill pay in both electronic and paper form depending on who you’re sending to.

(Note: While they do have electronic bill pay, it takes much longer than other large banks, because they use a 3rd party service. For an electronic payment to be received, it will take 4 business days.)

Free ATMs – All in-network ATMs are free, and Simple doesn’t charge fees for out-of-network ATMs, but usually the ATM owner does.

Free Cashier’s Checks – You can request a cashier’s check from Simple by sending them a message through the app or calling into their customer care. They will collect the information and get it on its way to you! (Most banks charge $8-$10 for this service.)

Automatic Tips – Simple goes above and beyond to help you from overspending and as part of that, for each transaction at a restaurant, they will hold an additional 20% as a future tip until the transaction posts to your account.

Once the transaction has posted with the actual tip you left, you’ll be able to go back in the app and see exactly how much was left as a tip and exactly what percentage it was!

Joint Accounts – They have reinvented the traditional joint account with this new feature, and it’s fantastic. Basically, each Simple customer has their own account, but by linking them you get an extra “joint” account that you each can put money into and spend money from.

Customer Service – Simple makes it painless to get in touch with an actual human, and they have a handy “chat” feature inside their app/website where you can log in and send a message to someone. Usually they respond within a couple of hours, and they are ALWAYS helpful. Very personable customer service team – no more stuffy, sad phone clerks!

The Bottom Line

Simple will help you save money and see your finances in a refreshing new way…if you make it important to use it the way it’s intended.

They are a free FDIC-insured account that’s both backed and owned by BBVA Compass – a nationally recognized leader in innovation through the banking industry.

A full-featured account that goes above and beyond to put the customer first.

While they have all the same great features as your regular bank account, but you may want to keep your account at your regular bank if you need to write checks on-demand or have a quicker bill-pay service.

NOTE: Simple has been known to pull Chexsystems for account openings in the past, but several users have reported that they may be more lenient than others. It is also possible they just use your QualiFile score.

Recent Comments